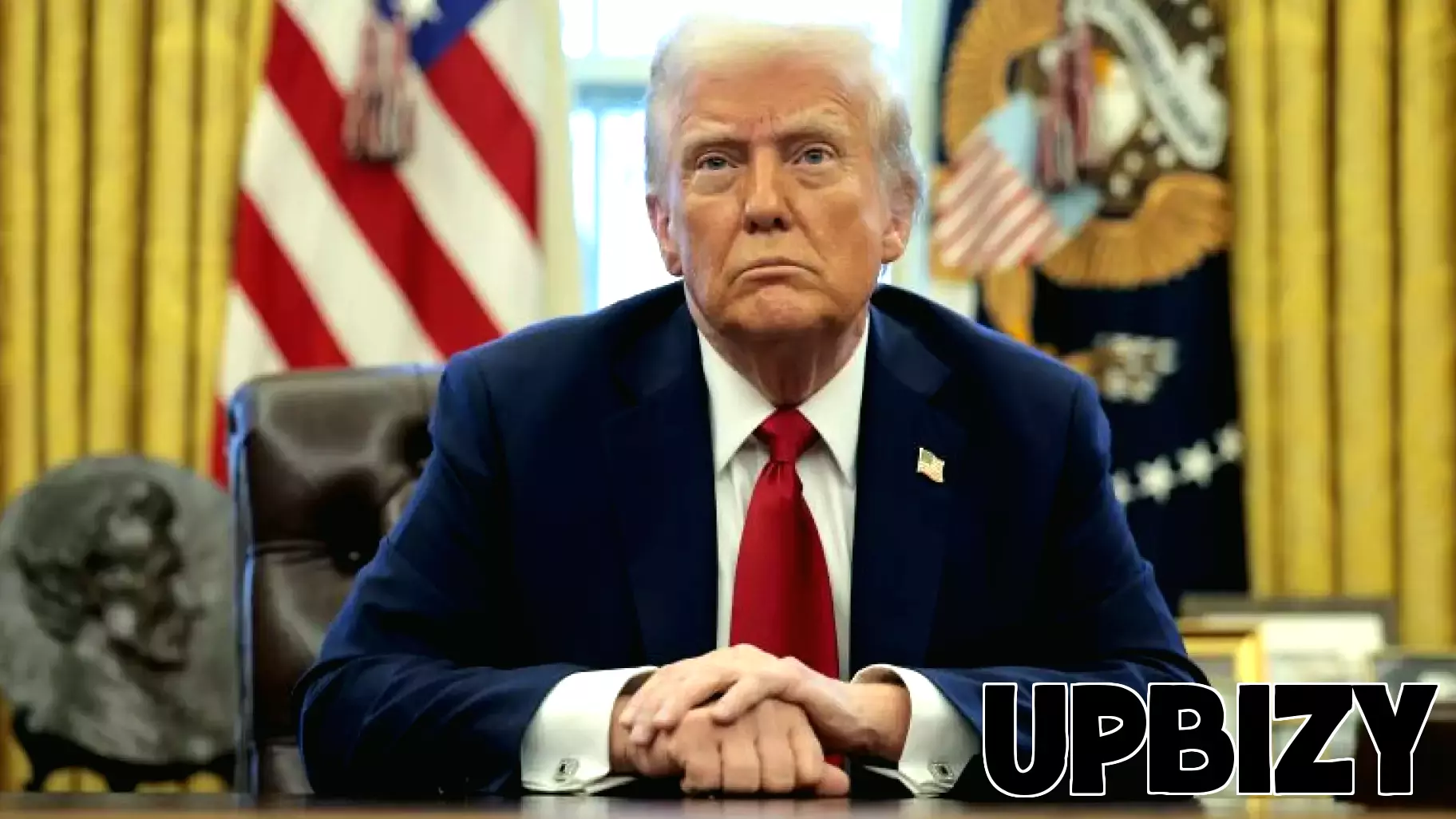

February 3, 2025 - 20:21

In a surprising turn of events, the anticipated tariffs under the Trump administration are set to reshape the economic landscape, leaving many analysts and investors grappling with uncertainty. Initially dismissed as a mere bluff, the prospect of these tariffs has gained traction, prompting a reevaluation of strategies across various sectors. Major financial institutions had previously deemed the likelihood of such measures as slim, leading to a sense of complacency in the stock market.

As the reality of these tariffs looms closer, companies that once hesitated to implement contingency plans are now scrambling to adapt. The potential for increased costs and disrupted supply chains has sparked a wave of concern among businesses, particularly those heavily reliant on international trade. The implications for consumers are equally significant, with the possibility of rising prices on imported goods.

As the nation braces for this new economic chapter, the unpredictability of the situation suggests that the journey ahead will be anything but smooth. Stakeholders are advised to stay vigilant as the impact of these tariffs unfolds across the economy.